Credit card companies are the banks and credit unions that issue credit cards to consumers and small business owners. They also service cardholders’ accounts by billing for purchases, accepting payments, distributing rewards and more. Examples of major credit card companies include Bank of America, Barclays, Citibank, Chase, Capital One and Wells Fargo. Credit card networks play a different role. They dictate where credit cards can be used, facilitate payment processing at the point of sale and administer secondary credit card benefits, such as rental car insurance, travel insurance and extended warranties. The four major card networks are Visa, Mastercard, American Express and Discover.

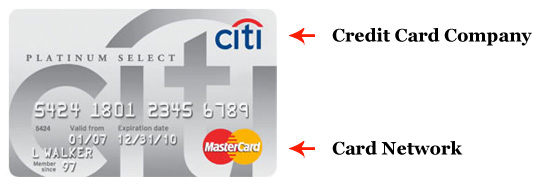

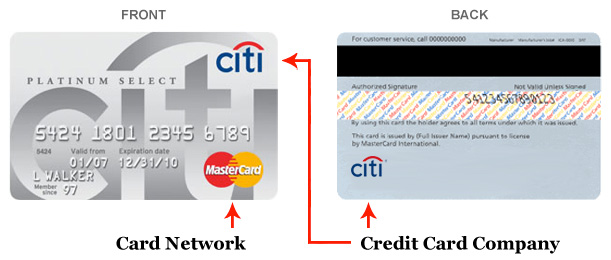

The names of both a credit card’s issuer and its network are listed on the front of the card. The only exceptions are store credit cards, which don’t belong to a card network and can only be used at the retailers they’re affiliated with.

The tricky part is that two of the world’s largest card networks – American Express and Discover – also issue credit cards. As a result, credit cards on the Amex and Discover networks are mostly issued by those two companies. A card on the Visa or Mastercard network could be issued by any other credit card company. Visa and Mastercard do not issue credit cards.

Major Credit Card Companies of 2020:

- American Express: 53.7M cards in circulation

- Bank of America: 54.6M cards in circulation

- Barclays: 15.7M cards in circulation

- Capital One: 89.4M cards in circulation

- Chase: 91.8M cards in circulation

- Citibank: 67.8M cards in circulation

- Discover: 57M cards in circulation

- Mastercard: 231M cards in circulation

- Navy Federal Credit Union: 3.3M cards in circulation

- Pentagon Federal Credit Union 0.6M cards in circulation

- PNC: 4.78M cards in circulation

- USAA: 7.7M cards in circulation

- U.S. Bank: 21.5M cards in circulation

- Visa: 337M cards in circulation

- Wells Fargo: 23.8M cards in circulation

Source: Nilson Report

Below, you will find scouting reports for the largest and most popular credit card issuers and card networks. This includes contact information, plus a breakdown of their performance in various WalletHub studies and reports. You can also learn more about the different roles that credit card issuers and networks play. We’ll even give you a sneak peek at the best major credit cards on the market right now.

Credit Card Companies

Credit cards are usually issued by banks and credit unions. They give these financial institutions a fairly steady source of revenue from account fees, interest charges and payment processing fees charged to merchants. The transactional nature of credit cards also gives issuers a chance to establish relationships with consumers. And that allows them to upsell cardholders to other products and services.

The heart of a credit card company is its underwriting team. Underwriters evaluate applicants’ credit history, income and debt load to determine whether their risk and profit potential merit account approval. The terms a credit card company offers to customers and its ability to turn a profit depend on how sophisticated its underwriting is and how well it can avoid uncollectible debt. Basically, if a credit card company approves people who pay their bills, it can better afford to reward them.

The following chart will show you which companies are the biggest players in the credit card game. You can also check out WalletHub’s Statistics Center for a more detailed look at the credit card landscape.

Market Share by Credit Card IssuerChaseBank of AmericaCitibankAmerican ExpressCapital OneDiscoverWells FargoU.S. BankRest16.1%11.8%11.7%22.1%4.1%4.5%7.5%10.4%11.6%

| Issuer | Share |

|---|---|

| Chase | 0.161 |

| Bank of America | 0.118 |

| Citibank | 0.117 |

| American Express | 0.116 |

| Capital One | 0.104 |

| Discover | 0.075 |

| Wells Fargo | 0.045 |

| U.S. Bank | 0.041 |

| Rest | 0.22 |

Note: Nilson Report and Federal Reserve data on outstanding credit card balances, as of Dec. 31, 2018.

If you aren’t sure which company issued your credit card, check the plastic. The issuer’s name typically appears in big fancy lettering in the top right or left corner of the card’s front. You’ll also find it at the bottom of the card’s back (see below).

This won’t necessarily be the case with store credit cards or co-branded cards, however. The name of the retailer or organization they’re associated with tends to be displayed most prominently. The issuer’s name will be on the card somewhere. But it may be more difficult to locate than with a normal credit card.

It’s important to understand which credit card company issued your card as well as which network it’s on. The former will tell you whom to call if you have a question about your account. And the latter will tell you where you can use your card, plus what fraud liability, rental car insurance and extended warranty policies apply to you.

If you are not sure which credit card company is right for you, or you’re looking for your credit card company’s phone number, check out WalletHub’s scouting reports of the major issuers below.

Scouting Report on Major Credit Card Companies

American Express

| Contact Info:1-800-528-4800https://www.americanexpress.com/ |

Established in 1850 in New York City, American Express now operates in more than 130 countries. As of 2018, Amex was the 4th largest credit card network in the U.S., based on number of cards in circulation. And it was the largest credit card issuer by purchase volume.

American Express also is known as the world’s largest issuer of charge cards and for targeting its products to high-income individuals with strong credit scores. As a result, Amex is a great source of lucrative rewards credit cards but is not heavily involved in the credit improvement space. It is interesting to note, however, that Amex has in recent years partnered with Walmart to offer the Bluebird Prepaid Card. This is the company’s first foray into the growing prepaid card market and appears to be an attempt to expand its consumer reach.

- American Express Reviews

- Application Transparency: 88.17%

- Uses Deferred Interest: No

- Balance Transfer Policy: Credit Cards & Store Cards Eligible

- NPSL Credit Card Policy: Good

- Chargeback Policy: Good

- Small Business Friendliness: 60%

- Foreign Transaction Fee: 0% – 2.7%

Bank of America

| Contact Info:1-800-732-9194https://www.bankofamerica.com/ |

Bank of America is one of the biggest financial institutions in the world, not to mention one of the largest companies overall. Headquartered in Charlotte, NC, the banking behemoth now has roughly 205,000 full-time employees and does $91+ billion in annual revenue. In addition to its credit card operation, Bank of America offers deposit accounts, investment vehicles, and financial management services to consumers. The company also has corporate and investment banking divisions.

Bank of America was founded in San Francisco in 1904. But it actually started out as Bank of Italy, in an attempt to serve the needs of America’s growing immigrant population. It was renamed in 1930, and the company’s continued expansion eventually led to the first ever general-use credit card, known as the BankAmericard. That product later became the basis for Visa.

Bank of America has since made numerous acquisitions. This includes its crucial all-stock purchase of Merrill Lynch at the Federal Reserve’s urging during the Great Recession. Like many other large financial institutions, BofA has also come under fire for various alleged wrongdoing during the downturn and beyond. But the credit card market is a much safer place these days. And Bank of America has actually been a leader in bringing consumer credit card protections to business credit cards.

- Bank of America Reviews

- Application Transparency: 99.88%

- Uses Deferred Interest: No

- Balance Transfer Policy: Credit Cards Store Cards & Auto Loans Eligible

- NPSL Credit Card Policy: Fair

- Chargeback Policy: Fair

- Small Business Friendliness: 100%

- Foreign Transaction Fee: 0% – 3%

Barclays

| Contact Info:1- 302-622-8990https://www.barclaycardus.com/ |

Barclays launched the first UK credit card program in 1966. And it moved into the U.S. market in 2004, with the purchase of Juniper Financial Corporation. The company’s U.S. credit card division operated under the brand name “Barclaycard US” until 2008, when it took its parent’s name.

Barclays is best known for its travel rewards credit cards as well as its suite of co-branded credit cards, issued in partnership with popular brands such as U.S. Airways, L.L. Bean, and the National Football League. Barclays credit cards typically require good or excellent credit for approval.

- Barclays Reviews

- Application Transparency: 99.82%

- Uses Deferred Interest: Yes

- Balance Transfer Policy: All types of Loans Eligible

- NPSL Credit Card Policy: Fair

- Chargeback Policy: Fair

- Small Business Friendliness: 85%

- Foreign Transaction Fee: 0% – 3%

Capital One

| Contact Info:1-800-955-7070https://www.capitalone.com/ |

Capital One is the 5th largest U.S. credit card company in terms of outstanding balances and purchase volume. The company was established in 1995 and is based in McLean, VA. It has roughly 1,000 branch locations in the District of Columbia, Louisiana, Maryland, New York, New Jersey, Texas and Virginia. In addition to credit cards, Capital One is known for everyday banking products, personal loans and auto loans.

Capital One has made a name for itself in the credit card market with offers for people of all credit levels, simple rewards programs and reasonable fees. The company’s Venture Rewards Card has long been regarded as one of the best travel rewards cards on the market. Its Quicksilver Card is one of the best everyday cash rewards cards. And the Spark Cash cards are among the top offers available to small business owners. Capital One also was the first credit card issuer to remove foreign transaction fees from all of its cards.

- Capital One Reviews

- Application Transparency: 100%

- Uses Deferred Interest: No

- Balance Transfer Policy: All Types of Loans Eligible

- NPSL Credit Card Policy: Fair

- Chargeback Policy: Excellent

- Small Business Friendliness: 60%

- Foreign Transaction Fee: None

Chase

| Contact Info:1-800-432-3117https://creditcards.chase.com/ |

Chase credit cards are issued by JPMorgan Chase & Co. – the largest bank in the U.S. by total deposits. Chase Bank was an independent entity – Chase Manhattan Bank – until its 2000 merger with commercial and investment banking giant JPMorgan. JP Morgan Chase now employs more than 250,000 people and does business in 100+ countries.

Chase is known for offering a wide range of credit cards, from its popular Freedom rewards cards to the free balance transfer card, Slate. Chase’s Sapphire Preferred and Sapphire Reserve cards also provide two of the most lucrative initial rewards bonuses on the market. And it offers co-branded cards in partnership with the likes of British Airways, United Airlines and Southwest Airlines. As you might expect based on the types of offers in its portfolio, Chase’s credit cards are mainly for people with above-average credit.

- Chase Reviews

- Application Transparency: 96.46%

- Uses Deferred Interest: No

- Balance Transfer Policy: All Types of Loans Eligible

- NPSL Credit Card Policy: Good

- Small Business Friendliness: 60%

- Rental Car Insurance: 93.50% – 91.00%

- Foreign Transaction Fee: 0% – 3%

Citibank

| Contact Info:1-800-347-4934*https://online.citibank.com/US/ |

*Tip: Most Citicards have their own customer service number. So if you’re looking for information about a particular card, type its name into the search box at the top of the page.

Citibank is the consumer banking division of the financial services company Citigroup. It was founded in 1812 as the City Bank of New York. And as of 2018, it was the third largest U.S. bank by outstanding balances.

Citibank targets the majority of its credit card offers to people with above-average credit standing. The company is known for offering cards with extended 0% introductory periods as well as a broad selection of rewards. Citi has two well-known rewards programs – ThankYou and Double Cash – in addition to co-branded partnerships with American Airlines and Expedia.

- Citibank Reviews

- Application Transparency: 97.35%

- Uses Deferred Interest: Yes

- Balance Transfer Policy: Only Credit Cards Eligible

- NPSL Credit Card Policy: Good

Discover

| Contact Info:1-800-347-2683 |

Discover is the country’s 7th largest credit card issuer and 6th largest card network, based on purchase volume through 2018. The company began as a division of the financial services company Dean Witter and was designed to issue the company’s Sears credit card. Discover Financial Services became an independent company in 2007.

Discover is known for offering cash rewards and was, in fact, the pioneer of the first cash back program. But the company now has a wide range of credit card offers, even though many of them have very similar names. Several different cards use the “Discover it” brand, offering 0% intro APRs, various types of rewards, and special perks such as a first-year rewards match. Discover also issues co-branded cards in partnership with a number of retailers and major universities. None of Discover’s credit cards charge foreign transaction fees.

- Discover Reviews

- Application Transparency: 96%

- Uses Deferred Interest: No

- Balance Transfer Policy: Credit Cards Store Cards & Auto Loans Eligible

- NPSL Credit Card Policy: Good

- Chargeback Policy: Excellent

- Small Business Friendliness: 30%

- Foreign Transaction Fee: None

PNC

| Contact Info:1-888-762-2265https://www.pnc.com/ |

PNC Financial Services Inc. – more commonly known by its ticker symbol, PNC – is the 6th largest U.S. bank in terms of total assets and deposits as well as the 12th largest credit card issuer based on purchase volume. As a regional player with a footprint in 19 states as well as the District of Columbia, the PNC brand is strongest east of the Mississippi River where the vast majority of its retail bank branches are located. PNC has particularly strong ties to Pittsburgh, the home of its corporate headquarters. In fact, PNC Park is home to the city’s professional baseball team – the Pirates.

Nevertheless, PNC is a full-service credit card issuer with offers ranging from secured credit cards for people with bad credit to rewards cards for small business owners. The majority of PNC’s credit cards, however, target people with stellar credit who are interested in earning rewards. It’s also interesting to note that roughly 40% of the company’s credit card offers are branded for small business use.

- PNC Reviews

- Application Transparency: N/A

- Uses Deferred Interest: No

- Balance Transfer Policy: Credit Cards & Store Cards Eligible

- NPSL Credit Card Policy: N/A

- Chargeback Policy: N/A

- Small Business Friendliness: 30%

- Foreign Transaction Fee: 0% – 3%

USAA

| Contact Info:1-800-531-8722https://www.usaa.com/ |

USAA – the United States Automobile Association – is a full-service financial institution that offers credit cards, banking products, insurance, and investment services to members of the military and their families. USAA is the 11th largest credit card issuer in the U.S. by purchase volume and outstanding balances, as of 2018.

- USAA Bank Reviews

- Application Transparency: 98.36%

- Uses Deferred Interest: No

- Balance Transfer Policy: All Types of Loans Eligible

- NPSL Credit Card Policy: Fair

- Chargeback Policy: Excellent

- Small Business Friendliness: N/A

- Rental Car Insurance: 88.50%

- Foreign Transaction Fee: None

U.S. Bank

| Contact Info:1-888-852-5786https://www.usbank.com/ |

*Tip: Most U.S. Bank credit cards have their own customer service number. So if you’re looking for information about a particular card, type its name into the search box at the top of the page.

U.S. Bank is the country’s 5th biggest bank in terms of total assets, the 4th biggest if you go by number of branches, and the 7th largest credit card issuer based on purchase volume. When it comes to credit cards, U.S. Bank is known for rewards. The company offers a number of co-branded credit cards with corporate partners like Kroger, Club Carlson, Ace, and Harley-Davidson. U.S. Bank rewards cards are also offered under the company’s FlexPerks brand name.

It’s interesting to note that while many of the major issuers known for their rewards target offers almost exclusively to people with above-average credit standing, U.S. Bank extends credit to people across the credit spectrum.

- U.S. Bank Reviews

- Application Transparency: 97.78%

- Uses Deferred Interest: No

- Balance Transfer Policy: All Types of Loans Eligible

- NPSL Credit Card Policy: Poor

- Chargeback Policy: Poor

- Small Business Protection: 45%

- Foreign Transaction Fee: 0% – 3%

Wells Fargo

| Contact Info:1-800-432-3117https://www.wellsfargo.com/ |

Wells Fargo was founded in 1852 to meet the banking needs of pioneers during the California Gold Rush. That’s not the only fun fact about the bank, either. Wells Fargo actually holds the first ever banking charter issued by the United States government, assuming it through the company’s 2008 acquisition of Wachovia. As of 2018, Wells Fargo was the 3rd largest bank in the U.S. in terms of total assets and total deposits.

Wells Fargo’s reach into the credit card market isn’t quite as extensive as its presence in the everyday banking space, however. It is the 8th largest credit card issuer in the U.S based on purchase volume. Nevertheless, Wells Fargo targets offers to people across the credit spectrum – from credit building credit cards to rewards credit cards to business credit cards.

- Wells Fargo Reviews

- Application Transparency: 88.75%

- Uses Deferred Interest: No

- Balance Transfer Policy: All Types of Debt Eligible

- NPSL Credit Card Policy: Fair

- Chargeback Policy: Excellent

- Small Business Friendliness: 70%

- Foreign Transaction Fee: 3%

Now that you’re familiar with the credit card industries biggest players, it’s time to get to know some of their most popular products. Below, you can find a comparison of some of these major credit cards that are definitely worth looking into.

Credit Card Networks

Visa, Mastercard, American Express and Discover are the four major credit card networks. To put it simply, card networks are important because you can only use your credit card at merchants that belong to its network. More specifically, they handle the worldwide processing of credit card transactions, acting as a gateway between consumers, merchants and credit card companies. They also set the terms for those transactions (e.g., interchange fee & fraud liability).

While the major credit card networks all perform a similar function, there are some important differences between them. As you can see from the graphic below, there is a clear hierarchy based on the number of retailers and cardholders each has in its portfolio. (Check out WalletHub’s Statistics Center for more card network market share information.)

Market Share by Card NetworkVisaMastercardAmerican ExpressDiscover48.4%7.5%12.3%31.8%

| Issuer | Share |

|---|---|

| Visa | 0.484 |

| Mastercard | 0.318 |

| American Express | 0.123 |

| Discover | 0.075 |

Note: 2018 data on U.S. credit card outstanding balance, from the networks’ SEC filings.

Visa, Mastercard, Discover and American Express also differ in terms of where they can be used – both in the U.S. and abroad. The benefits they provide have earned varying grades in WalletHub’s research, too.

Here’s how the major credit card networks compare:

| VISA | MASTERCARD | DISCOVER | AMERICAN EXPRESS | |

|---|---|---|---|---|

| U.S. Acceptance | 10.7 million merchants | 10.7 million merchants | 10.4 million merchants | 8.5 million merchants |

| International Acceptance | 200+ countries | 210+ countries | 185 countries | 160+ countries |

| Fraud Protection | Good | Good | Excellent | Excellent |

| Contact | 1-800-847-2911 | 1-800-627-8372 | 1-800-347-2683 | 1-800-528-4800 |

Source: Feb. 2017 Nilson Report, card networks’ websites and WalletHub research.

It’s also important to reiterate that American Express and Discover aren’t just card networks. They’re credit card issuers, too. So if you have a problem with your Discover bill, for example, you can contact Discover directly. But if you have a problem with your Visa bill, you’ll have to contact the card’s issuer – Capital One, for instance.

Major Credit Cards:

Now that you’re familiar with the credit card industry’s biggest players, it’s time to get to know some of their most popular products. Below, you can find a comparison of some major credit cards that are definitely worth considering.

| Category | Card Name | Annual Fee | Min. Credit Required | Editor’s Rating |

| Travel Rewards | Capital One® Venture® Rewards Credit Card | $95 | Good | 5.0 / 5 |

| Cash Back | Citi® Double Cash Card – 18 month BT offer | $0 | Excellent | 5.0 / 5 |

| Initial Bonus | Chase Sapphire Preferred® Card | $95 | Good | 4.8 / 5 |

| 0% Intro Purchases | The Amex EveryDay® Credit Card from American Express | $0 | Good | 4.5 / 5 |

| Balance Transfer | Wells Fargo Platinum card | $0 | Good | 4.6 / 5 |

| Fair Credit | Capital One® QuicksilverOne® Cash Rewards Credit Card | $39 | Limited History | 4.7 / 5 |

| Limited Credit | Capital One® Platinum Credit Card | $0 | Limited History | 5.0 / 5 |

| Bad Credit | Capital One® Secured Mastercard® | $0 | Limited History | 5.0 / 5 |

| College Students | Journey® Student Rewards from Capital One® | $0 | Limited History | 5.0 / 5 |

| Business Owners | Capital One® Spark® Cash for Business | $0 for 1st yr, $95 after | Good | 5.0 / 5 |